Starting Early Matters

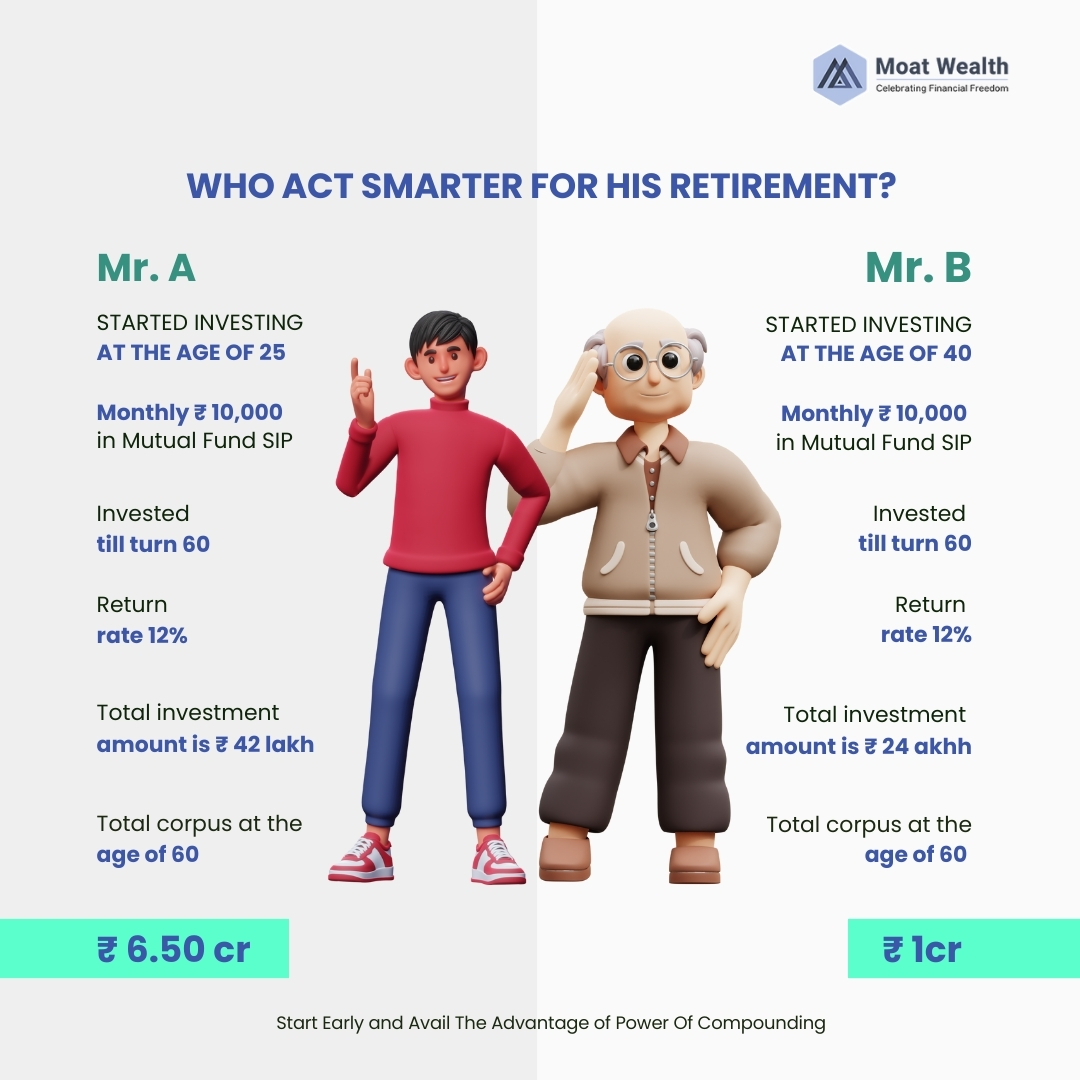

The best time to plant a tree was 20 years ago. The second-best time is now.” Investing early brings benefits and allows you to achieve your financial goals without stressing over investing a large sum in the later stage of your life. Here is how early investing can help you:

- Earn compounding returns

- Affordable monthly investments

- Planned strategy and execution

- Space to digest short-term volatility

- Achieve financial independence

Start early and grow your wealth

Goals of Youngsters

How we can help you achieve your goals

Every vision needs action and so do your investments

- Tailored and personalised investment

- Investing as per your unique needs

- Tracking and achieving financial goals

- Regular portfolio monitoring

- Stress-free proces

What do our users say?

To know more, book an appointment!

FAQs

How is goal-based planning different from the traditional investment approach?

Goal-based investing is a personalised investment approach, unlike traditional investing which is focused only on gaining returns. In goal-based investing, you make investment for specific life objectives. By identifying your short-term, medium-term, and long-term goals, goal-based investing tailors your investment strategy to meet these milestones

What are common goals that I should focus on as a young investor?

As an individual in your early adulthood, some of the common investment goals can be short and long-term purchases such as buying a car or a house, saving for an emergency fund, investing for future requirements and starting early investment to build a sizable retirement corpus. Each of these goals needs attention and a tailored investment strategy which goal-based investing caters to and helps you achieve success

Why is it important to do goal-based planning?

Goal-based investing focuses on helping you achieve your short and long-term goals via a systematic approach. You need discipline and a clear path while investing money and achieving your goals, for which goal-based investing is an important strategy.

What benefits can I expect by starting investment in my 20s?

There is a wide range of benefits you can expect by starting your investment journey in your 20s such as compounding returns on your investment, overall ease of investing with a lower monthly contribution, a longer time frame to achieve your goals and eliminating the impact of market fluctuations in the short run.

How does Moat Wealth approach goal-based investing?

At Moat Wealth, we understand the unique challenges and opportunities that you face as a young investor. We have an experienced team of financial advisors to create personalised investment plans to fit your unique preferences, life stage, and risk profile. We help you create a strategic plan and are committed to helping you build a brighter financial future.